An SME (Small to Medium Enterprise) are often smaller companies or businesses compared to MNCs (Multi National Corp). MNCs are corporations that have facilities and assets in at least one country other than its home country.

As fresh graduates we often debate with ourselves which would be a better career opportunity as a first job. A Multinational corporation (MNC) or a Small to Medium Enterprise (SME)?

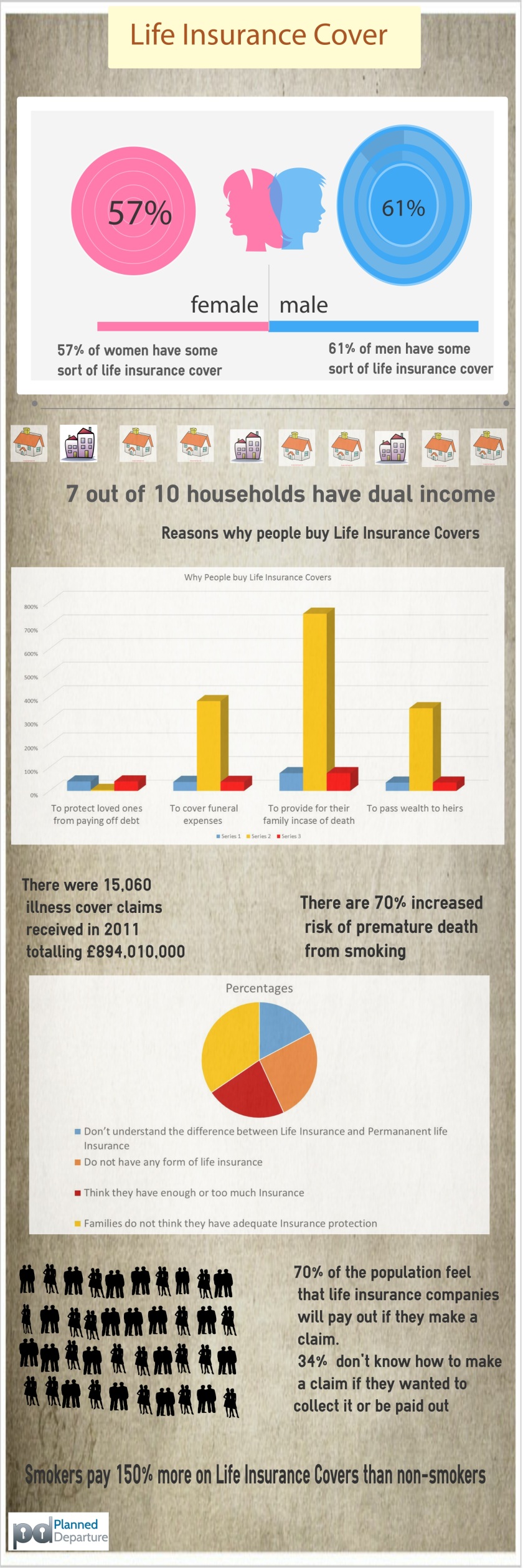

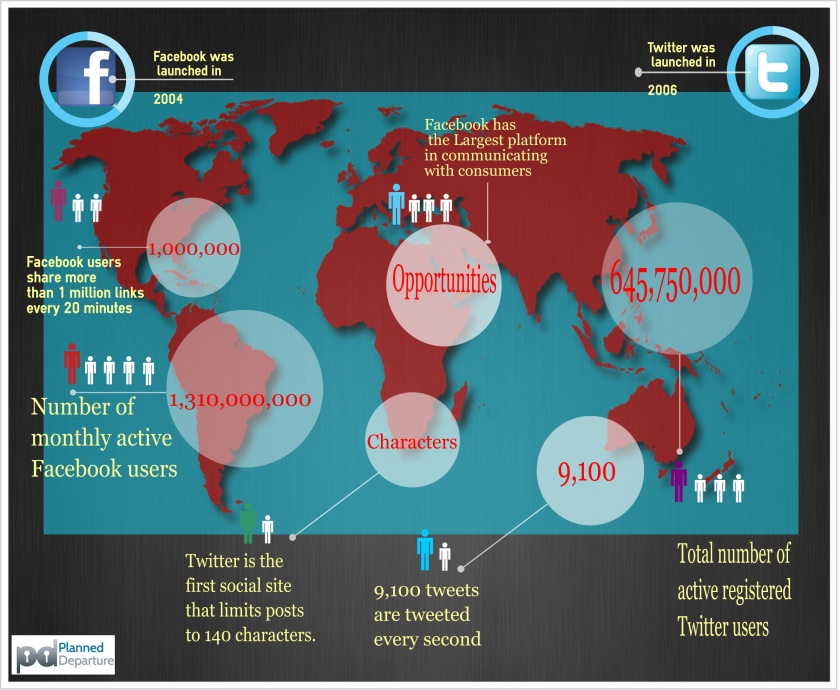

I have a few weeks to go before I graduate from Kingston’s MA in creative writing and publishing programme. I decided to look for a job before completion to reduce the job search burden and process. I read about a job role with a start-up company called Planned Departure. Initially I had not thought about working in a SME. It was all about the big companies for me, after all those were the ones I had heard of while growing up and had read about mostly but I decided to apply.

I was hired as the Social Media Marketing Executive of the company which was amazing.

When I started my job, I realised MNCs have their perks. A good and steady income, a well-established name and brand, security in the workplace, a good amount of people to share your workload, the opportunity to learn from experts who have been working in the field for years and many more.

But working with a start-up is different and better. Here’s why…

Before I begin, let me just say one of my major fears as I started this job was that it might fail or cease to exist in a few months or years. I thought again and realised, nothing is guaranteed in life. Even with MNCs something could happen that could completely change their dynamics and make them cease to exist too – so why not give this a go.

In a start-up everything is new. There is so much you can learn and there is so much room to grow.

As I started my new role, I quickly realised there was a lot to learn. In a few weeks I was responsible for most of the social media channels. I quickly learnt and adjusted to my tasks. With each task I learnt something new. Instead of having a specific role like you normally would in an MNC, I was able to give myself the chance to explore different departments in the company. The freedom to work and learn as I worked was amazing.

At work it’s not just a company but I feel like I am part of a family which I know I could never feel at an MNC.

The employers take time and actually listen to you and guide you through various tasks.

Efforts and skills are recognized easily and appreciated which helps in boosting your confidence and making you proud of your hard work done.

It provides amazing one-on-one learning sessions with the founders and the rest of the team. This enhances the skills and knowledge you already have, preparing you for a bigger role in an MNC. I personally think we should learn to walk before running. If you can survive and succeed in a start-up company or SME, you can succeed anywhere else.

I have learnt a lot that can help me in future for my own business I set up.

With MNCs mostly there’s no personal relationships established which often means no loyalty. With an SME over months and years of working so closely, you build a relationship which often results in the company being loyal to you (sometimes) when it grows bigger and eventually becomes an MNC.

These are a few reasons why I personally prefer SMEs to MNCs. They both have their advantages and disadvantages but it depends on what you personally want to achieve in life that helps influence your decision on which to choose after school. Your goals, aims, income expectations, work – life balance, etc.

It helps in gaining experience so SMEs often tend to give you more than MNCs. This prepares you for starting your own business or joining an MNC for a higher role.

Plan your career, think about where you want to be in 5 years and let that motivate and inspire you.

Make a decision today that your future self will be proud of. Do your research, speak to people and gather as much information as you can, to help you in making an informed decision.

BTW, two more people from Kingston joined Planned Departure with me. This is what they have to say about it –

Ismail Pervez – Corporate Sales & Operations Executive

“Being a strong believer in only working for a top organisation during my university life, my choice of decision between an SME or MNC was very stressful as I had 3 job offers, two from well established companies and 1 start-up. But looking at different aspects and aspirations, I made the decision to work in an SME because of an opportunity to turn that organisation into an MNC and the challenge it will bring upon myself to succeed and learn as on the contrary, the established company will train me and follow directions and rules where I would be restricted and not have flexibility to experience other areas or have an involvement for the company growth. I would recommend each student to carefully choose their workplace, according to the expected outcomes they want to achieve”.

Nam Nguyen – Marketing Executive

Having worked for both MNCs and SMEs have given me the opportunity to experience what is it like to work in a small and big organisations. Both of them have their advantages and disadvantages. In a MNC you earn prestige, confidence and connections that can give you a big push for future job applications.

But in terms of learning and skills, SMEs are the preferred ones by me. While working at Planned Departure I have been able to get involved in many activities from the day-to-day running of the business. I have been able to touch on every aspect of the business from – Marketing, Sales, Operations, Lead Generation, Media Engagement and many more for just 3 months. This has given me confidence and knowledge to one day run my own SME.

I would suggest students to not be afraid to join SMEs if they have the chance, because sometimes not everything bigger is better.

Best of luck 🙂